Announcing RSF Prime

Nov 10 2009

Dear Friends,

We are excited to announce an important shift in how we determine the rate of return each quarter for the RSF Social Investment Fund (SIF), which in turn determines the base interest rate we charge to borrowers through our Core Lending program.

As of October 1, we have adopted a customized rate determined each quarter collaboratively by representatives of all three stakeholders in the RSF Social Investment Fund – investors, borrowers, and RSF staff. A 4% spread (used to fund RSF’s operations) is then added to this customized SIF rate to determine the base rate for borrowers in our Core Lending program. We have dubbed this new base rate for borrowers “RSF Prime”.

For many years, we based our investors’ return rate on the 13-week U.S. Treasury Bill. Each quarter we recalibrated the rate based on this well-publicized benchmark. In 2006, we shifted to a different benchmark – LIBOR, or the London Interbank Offered Rate – because it represents the most commonly accepted barometer for short-term interest rates worldwide. However, we no longer believe it is appropriate to use a benchmark like LIBOR or the U.S. Treasury Bill.

Based on our close reading of Rudolf Steiner’s lectures on economics, we believe the community of participants in SIF can most accurately determine a price that meets the needs of all parties. We have started hosting quarterly face-to-face meetings at our offices in San Francisco with representatives of the three stakeholder groups.

We believe this is the first time that a lending institution has facilitated meetings between investors and borrowers to determine loan pricing. With RSF staff at the table facilitating the conversations, all three stakeholders can be visible to each other and engage in a direct and transparent exchange in an effort to understand intentions, motivations, and needs. We believe this new methodology fits better with our values – to make financial transactions as direct, transparent, and personal as possible.

This year, the groups have been small. In the years to come, we intend to host meetings in different regions of the country each quarter to connect with more of our stakeholders. We have heard from investor participants so far that it is a wonderful way to learn more about the inspiring projects they support.

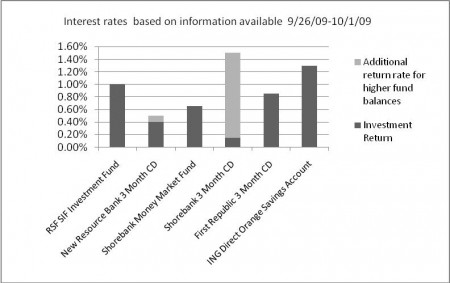

This shift also allows us to offer our investors a significantly higher return this quarter (1.00%) than would have been possible using LIBOR or the U.S. Treasury Bill as our reference. We are aware that the investor return rate has been very low for the past three quarters (0.50%-0.71%). The chart below indicates select 3-month bank CD rates and money-market funds for comparison.

So, again, this change has two significant benefits:

- We believe it brings the loan pricing exercise into clear alignment with our foundational values.

- It gives us flexibility to offer our investors a higher return in extreme low-interest-rate environments like what we face today.

RSF places tremendous value not only on the result, but also on the process, and the source of financial transactions. We can define the result as “what” we support (socially and ecologically beneficial projects); while the process refers to “how” we do our work (transformative learning through community). Importantly, we also explore the source of each transaction, the “why” behind it (intention; spiritual basis).

It is the integration of all three elements of working with money (what, how, why) that distinguishes what we do at RSF from other financial institutions. We truly believe that, together with our clients, we are transforming the way the world works with money. I hope that this change to a more values-aligned process will inspire more of you to join us on this journey, and look forward to hearing your thoughts and questions.

All the best,

Don Shaffer

President & CEO

Dear Friends,

We are excited to announce an important shift in how we determine the rate of return each quarter for the RSF Social Investment Fund (SIF), which in turn determines the base interest rate we charge to borrowers through our Core Lending program…