Investment Strategies: From Carpetbagging to Community

Jun 14 2010

By Leslie Christian

This is the fourth entry in a 6 part series by Leslie Christian on rewriting modern portfolio theory to recognize the reality of ecological limits to economic growth. To read Leslie’s other blog posts on the subject, use the links at the bottom of this post.

In my last blog post, we defined three “risk responses” — Ostrich (deny or ignore ecological limits), Musical Chairs (keep going until ecological disasters finally overwhelm the markets), and Plan B Now (radically rethink investing) — in an effort to link the non-negotiable reality of ecological limits with the possibility of zero to negative GDP growth over a long period of time. To the extent that GDP growth continues to depend upon resource extraction, consumption, and waste, this is a very real possibility – and not, as some may label it, an alarmist overreaction.

In my last blog post, we defined three “risk responses” — Ostrich (deny or ignore ecological limits), Musical Chairs (keep going until ecological disasters finally overwhelm the markets), and Plan B Now (radically rethink investing) — in an effort to link the non-negotiable reality of ecological limits with the possibility of zero to negative GDP growth over a long period of time. To the extent that GDP growth continues to depend upon resource extraction, consumption, and waste, this is a very real possibility – and not, as some may label it, an alarmist overreaction.

In this article, I will provide an overview of the investment strategies that follow from the aforementioned risk responses. While ecological limits and their associated risks to our economy are not a choice, we do have choices in the way we deal with them and these choices have consequences. The following three investment strategies seek to frame the potential consequences.

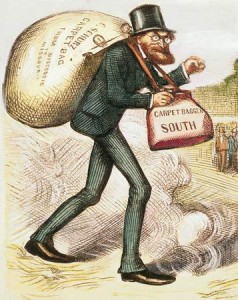

Strategy 1: Ecological Carpetbagging

The “Ostrich” response to the possibility of negative financial returns due to ecological limits is to ignore them and engage in business as usual. That is, continue and even increase resource-intensive activities, build for obsolescence, and focus on quantity over quality. Even though an Ostrich may not define it as such, this behavior is exploitive of people and the planet; it compromises future generations, encourages consumption, embraces wealth and income inequality, and reflects a short-term mentality that might better be described as shortsightedness. Ironically, this behavior is currently considered “prudent” by most fiduciaries.

Even if investors understand the reality of ecological limits and the possibility of negative financial returns, they may still engage in Ecological Carpetbagging, choosing to use their insights to “get while the getting’s good.”

Ecological Carpetbagging, which I’m defining as profiteering through exploitation of human and planetary resources, is unfortunately another way of describing the bulk of the investment activities in our global economy — from high frequency trading and dark pools, to hedge funds, most mutual funds, most private equity, most venture capital, and most real estate. All these strategies are risky in that they depend — directly or indirectly — on perpetual, albeit irregular, economic growth, earnings growth, and perpetuation of stock market valuations.

Strategy 2: Global Good

This strategy appeals to investors who understand ecological limits and the problems with economic growth as we currently experience it, but who can’t accept a zero or negative growth scenario. They turn to innovation, creativity, and adaptation as the way to a new kind of dematerialized growth, and express great faith in technology and the cleverness of human beings to somehow overcome the reality of ecological limits. They work to turn the global economy into “Global Good.” Still operating within an exploitive model, these investors tend to place a high value on selecting good (and smart) companies that they expect to continue to grow while others fade away. There is a focus on remediation, harm reduction, and efficiency — making things better in time to prevent ecological and economic collapse.

Global Good investing includes green technology and renewable energy investing, sustainable investing, and socially responsible investing via public stock markets and mutual funds, private equity, and venture capital.

While Global Good investing is appealing, it remains risky because equity (stock) prices are based on expected growth of future earnings. With this foundational assumption in question, Global Good investors depend on their ability to believe in the short-term “rightness” of this type of investing while relying on hope for the long-term.

Strategy 3: Transition to Community

The tagline for this strategy could be: “Get out of the casino (the stock market) and into the real world.” If there is indeed a real possibility of a shrinking economy and negative financial returns, doesn’t it make sense to put some effort into investing in local self-sufficiency, relationships, stability, and trust? Aside from the social and psychological benefits of connection and community, financial transactions that are exchanges of value rather than speculation, and returns that are sufficient but not exploitive, are at the very heart of a functional economy. To the extent that investors can identify opportunities to build real economic value based on solid ecological principles, they will benefit.

Transition investing currently involves community bank CDs and loan funds. For accredited (wealthy) investors, there are some private funds and companies that are focused on local economies. Importantly, though, we are in the midst of a transition in thinking. The old way of thinking was that local investing was a high risk/below-market-return activity. This is no longer a fair assumption. In the context of ecological limits and the risk of zero or negative growth, investing in local economies may prove to be the least risky strategy and a conduit for creating high economic value (versus short-term financial returns).

As you think about these three investment strategies — Ecological Carpetbagging, Global Good, and Transition to Community — consider how your current investment portfolio is allocated and how you think it should look based on your own increasing awareness of ecological limits and their current and future impact. In upcoming posts, I will discuss more specifically the characteristics of each strategy, as well as approaches for evaluating Global Good investing and proposals to advance Transition to Community investing.

Leslie E. Christian is Chief Investment Officer and Chief Executive Officer of Portfolio 21 Investments. She has more than 35 years of experience in the investment field, including nine years in New York as a Director with Salomon Brothers Inc. She received her bachelor’s degree from the University of Washington and her MBA in Finance from the University of California, Berkeley. Leslie is Chair of the Board of Upstream 21 Corporation and Portfolio 21 Investments and serves on the RSF Social Finance Investment Advisory Committee.

Other Posts in This Series:

- Social Finance from an Investor’s Perspective

- Getting Serious About Long-Term Investing

- Allocate Your Risk Response: Ostrich, Musical Chairs, or Plan B?

- Investment Strategies: Getting Down to Details on Eco-Carpetbagging, Global Good, and the Transition to Community

- No Time to Lose: A Call to Action for Impact Investors

In my last blog post, we defined three “risk responses” — Ostrich (deny or ignore ecological limits), Musical Chairs (keep going until ecological disasters finally overwhelm the markets), and Plan B Now (radically rethink investing) — in an effort to link the non-negotiable reality of ecological limits with the possibility of zero to negative GDP growth…