2016 RSF Prime Rate Change

Jan 20 2016

by Don Shaffer

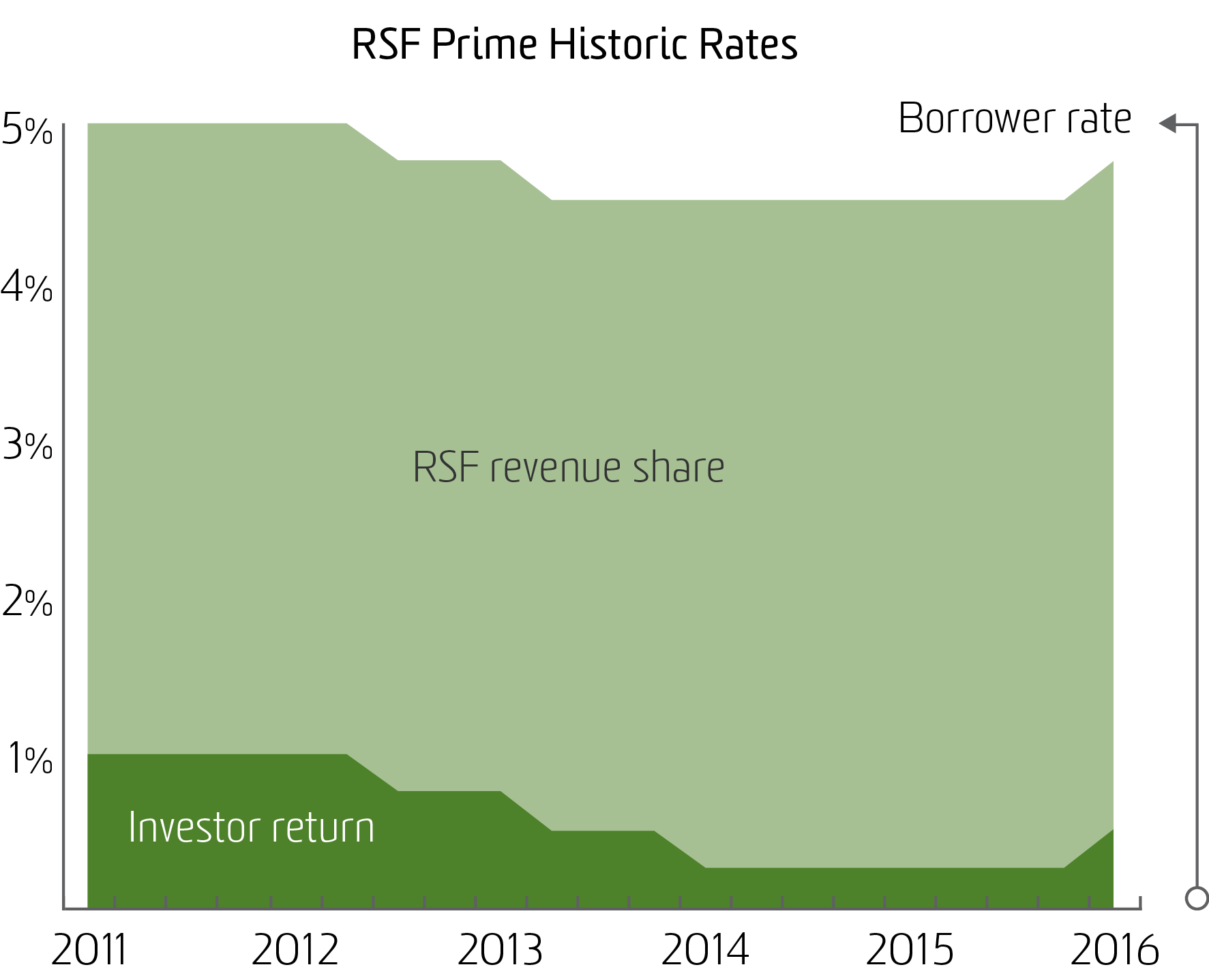

On January 1, 2016, RSF Social Finance increased its base interest rate for borrowers to 4.75 percent. Other participants in the Social Investment Fund (SIF) are affected as follows: the investor rate is now 0.50 percent, up from 0.25 percent, and the RSF revenue share will remain at 4.25 percent.

The decision to raise investor returns, which subsequently increased borrower rates, is the result of a long-standing RSF practice of community pricing. In the fall of 2009, RSF leadership made the bold decision to take how we set our loan pricing off-the-grid. Moving forward, rather than peg our rates to flawed benchmarks such as LIBOR, RSF set out to base price on the needs of its stakeholders and the conditions of the marketplace. This approach is inherently less volatile, more transparent, and recognizes the interdependence of all parties — values we see as essential in a healthy financial system.

Prime Over Time

Over the past five years, RSF Prime has changed three times. In each of these adjustments, the rate paid to investors has been lowered. The January 1st change will mark the first increase since the fourth quarter of 2009.

Increasingly, we have heard from investors that the return they receive from RSF has become one of the lowest yielding investments in their social impact portfolio. We do not dispute that there are higher yield options out there. And even though the most recent increase to RSF Prime does not translate to significant dollar gains for investors, we contend that it remains competitive with other low-risk, liquid, and high-impact funds. All said, we are proud of the fact that RSF investors remain staunchly supportive of our transformative money efforts—seeing them as more important than the financial returns they earn.

On the borrower side, many recognize that RSF’s community pricing approach has been in their favor for a number of years. At pricing meetings and in private conversations, many borrowers conveyed that they could tolerate a small increase in their loan rate.

It should be noted though that not all borrowers share this perspective. Schools and other non-profit borrowers have expressed understandable concern that the rate change could not be absorbed by their tight operating budgets. Although we advise borrowers truly struggling with the rate adjustment to contact their RSF lending manager, we also contend that RSF still offers one of the lowest borrowing costs in the market today.

Many Factors, One Decision

The SIF Pricing Committee, which makes the final decision regarding RSF Prime, considers many factors when evaluating whether or not a rate change makes sense. These include:

- The recommendation given by attendees of RSF’s quarterly pricing meetings. A convening of investors, borrowers, and select RSF team members, these meetings represent an opportunity for stakeholders to address and hear each other’s needs in a personal way.

- Feedback gained through client conversations by the lending and client engagement teams.

- Market pressure. RSF is neither the cheapest borrowing source nor the highest-yielding investment option out there; and neither do we want to be. This does not mean, though, that we operate in vacuum. RSF staff tracks what is happening in the market with the goal of anticipating moves that could influence the needs of our community.

- RSF needs. There are costs associated with lending that range from hiring and retaining high-capacity staff to ensuring the security of sensitive information. We hold that these organizational needs must be balanced within the needs of the whole.

Honoring the system

As financial and economic markets continue to fluctuate, we anticipate conversations about RSF pricing to grow more challenging. As a result, the discussions that we have with each other daily and at quarterly pricing meetings will be more important, as they will ground our relationships and build trust. Regardless, RSF is committed to honoring our community pricing approach, and will continue to facilitate this central dialogue to transforming the way the world works with money.

Don Shaffer is President & CEO at RSF Social Finance.