Climate and Energy

Let’s invest in a healthier planet and a cleaner climate.

Heavy reliance on fossil fuels is contributing significantly to carbon emissions and climate change. The United States still depends on non-renewable resources like coal and oil for more than 90% of its energy needs. Continuing our dependence on resource extraction isn’t just harmful for people and planet; it’s unsustainable, as those sources will eventually run out.

But another climate future is possible.

RSF finances social enterprises that prioritize long-term regeneration over resource extraction. These businesses and nonprofits provide renewable energy, sustainable building materials, environmental education, and more. They advance sustainability, support a healthy environment, and promote long-term ecological health.

Through these investments, RSF aims to reduce emissions, mitigate climate change, improve climate resilience in vulnerable communities, advance the long-term sustainability of natural resources, and help people live happier, healthier lives. Together, we can make sure that people and planet have the resources they need to thrive for generations.

Our Impact

8

climate and energy enterprises funded in 2024

$25MM

loaned in 2024

22%

of RSF’s portfolio in 2024

Invest in sustainability

By purchasing an RSF Social Investment Fund note, you’ll expand access to renewable energy, sustainable construction materials, environmental education, and more.

Apply for a loan

RSF offers term loans to support new renewable energy installations, working capital to help your enterprise meet its sustainability goals, and custom financial products to respond to needs as they arise.

Latest news

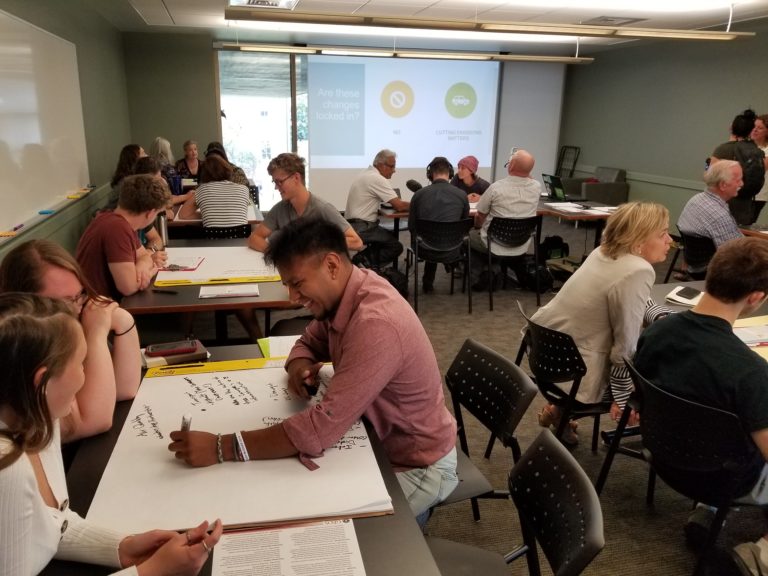

Alternative Ownership 101: Five Takeaways from Our Conversation with Equal Exchange, Organically Grown Company, and Purpose Trust Ownership Network

In a recent conversation hosted by RSF, leaders from Equal Exchange, Purpose Trust Ownership Network, and Organically Grown Company explored a question that sits at the heart of regenerative finance: Who is business for?

Announcing our new CFO, Marc Diaz

As CFO, Marc is in charge of making sure that RSF’s capital stack and finances are as robust and regenerative as the financial system we’re building in the wider world. Our CEO Jasper van Brakel recently sat down with Marc to learn more about what drew him to RSF, his approach to this leadership role, and his vision for RSF’s future.

Move with Change: A Principle of Regenerative Finance

This blog series breaks down each of the five principles that guide our work in regenerative finance. Here, we’re covering the fifth and final principle: Move with Change.