A decade ago, I left the finance industry when I realized that a large part of the financial returns it generated was made possible by shifting costs and risks to others – especially natural ecosystems and vulnerable communities. I tell my personal story of my decision to leave the finance industry here.

Since then, I have devoted myself to the Great Turning – the shift in society and all its institutions necessary to bring about a socially just, environmentally regenerative, and spiritually fulfilling human presence on planet Earth.

This societal transformation is in its infancy, but its urgency was put in stark relief by a recent article published on November 5, 2019 in the journal BioScience titled “World Scientists’ Warning of a Climate Emergency,” that covers the “vital signs” of planet Earth over the last decade.

The article begins:

Scientists have a moral obligation to clearly warn humanity of any catastrophic threat and to “tell it like it is.” On the basis of this obligation and the graphical indicators presented below, we declare, with more than 11,000 scientist signatories from around the world, clearly and unequivocally that planet Earth is facing a climate emergency.

The article concludes that “An immense increase of scale in endeavors to conserve our biosphere is needed to avoid untold suffering due to the climate crisis.”

Source: World Scientists’ Warning of a Climate Crisis. Bioscience November 5th, 2019

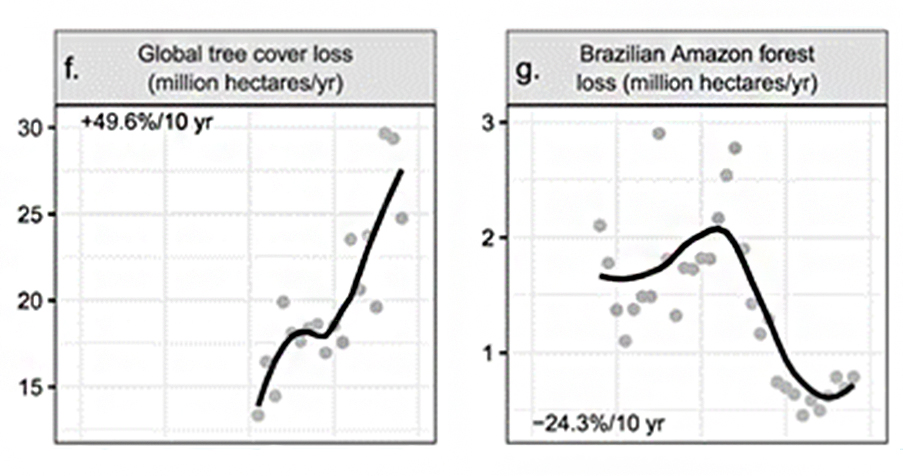

Since the beginning of 2019, about 3,000 square miles of Brazilian Amazon forest were destroyed.

And of course, the Amazon is burning because the companies setting it ablaze are doing so to raise cattle or soybeans for the international agricultural commodity markets and to repay their bank loans or meet the financial targets set by the private equity firms that own them.

Similarly, the large multinational corporations who will purchase the cheap meat or soybeans will have to meet their earnings expectations to support their stock price and deliver a decent return to the mutual funds or investors who own them.

Source: World Scientists’ Warning of a Climate Crisis. Bioscience November 5th, 2019

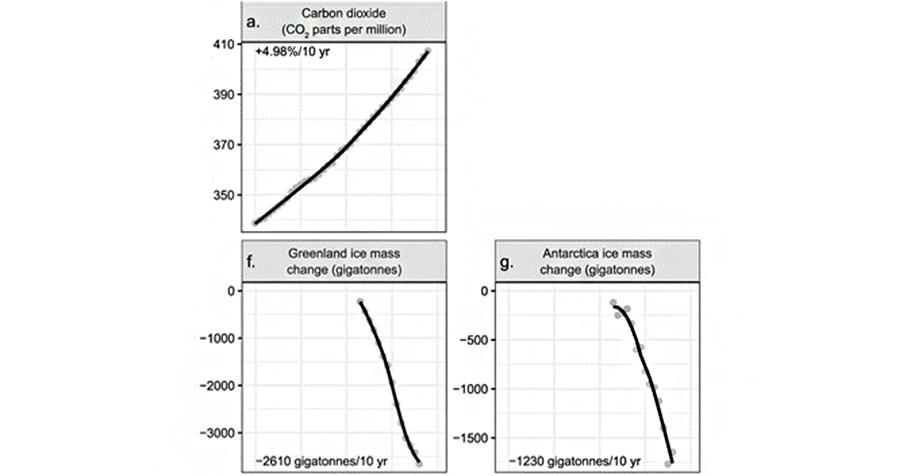

The concentration of CO2 in the atmosphere is now more than 400 ppm (co2now.org). In 2019, we emitted an additional 35 GT of CO2 into the atmosphere and the Antarctic and Greenland ice masses have declined by a combined 400 GT.

Further, the ice mass in Greenland and Antarctica is collapsing because tar sand and fracking companies need to repay their bank loans and deliver on the financial targets of the private equity firms who own them. These destructive practices are justified so that these companies can meet the earnings expectations that support their stock price, and to generate adequate financial returns for the mutual funds or investors who own them.

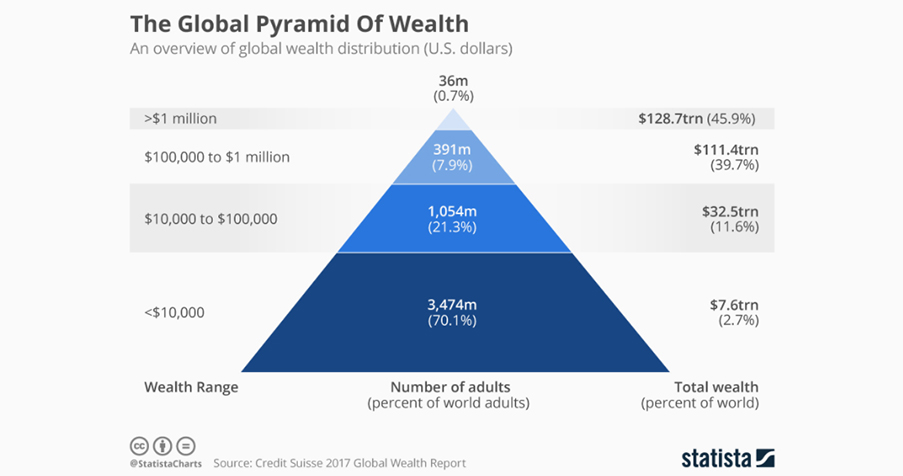

We know that wealth inequality is problematic, and its worldwide increase corresponds to drift away from democracy, and towards authoritarianism.

The top 10% of the human population owns more than 85% of the financial wealth–this reflects the most unequal wealth distribution in the history of humankind. To the extent that the return on financial capital is higher than the 2-3% growth rate in the global economy, wealth inequality will keep increasing, thus tearing apart the very fabric of society.

If you step back, what you see is that our societies and global ecosystems are undergoing a massive transformation directed by capital’s need for perpetual growth. It is a transformation that is not compatible with the health of societies or that of global ecosystems and therefore, is not compatible with human survival.

My main engagement with the Great Turning has been to highlight the importance of becoming aware of the non-financial impacts of our investments as one of the fundamental prerequisites for evolution. Once we reach an understanding of the connection between our investments and the existential crisis we are facing, our collective determination to survive might allow for an alternative developmental path for our societies and ecosystems.

But there’s a catch. Whether we continue on the current path or undergo a deliberate, conscious transformation of our society and all its institutions to bring about the conditions for the continuation of our species’ survival, the financial markets will undergo a dramatic transformation. This reckoning would upend the way we act as financial intermediaries and investors. In my opinion, there is at least an 80% chance of such a reckoning occurring in the next decade.

I recently developed a course for investors and financial advisers to equip them with advance warning of such upcoming and dramatic changes, including strategies for shifting their personal investments or their business practice as financial intermediaries necessary to navigate the turbulent times ahead. The course was well attended and well received. Here is a testimonial by one of the financial advisers who participated in the course.

I can’t remember the last time I participated in something as deeply thought-provoking as Marco’s course. He weaves a cohesive narrative that ties together the workings of our financial system and the state of the natural environment, and the impact we have on these systems (both as individuals and financial planners). As someone well-versed in capital markets, I was particularly interested in Marco’s exploration of the assumptions which underlie our financial thinking – both those that we currently use and those we don’t. And when we upend the assumptions, where does it leave us? Marco answers these questions with analytical rigor and elegant simplicity. – Jeremy Levinn

The course will be offered again by Money Quotient University starting in February 2020. While the course has been designed for financial advisers, it is open to individual investors as well. Here is the course description and the link to register.

https://www.moneyquotient.org/events/mqu-marco

We need to embark on the journey of becoming aware of our agency in the world as expressed through our investments and in the effort to shift them in a more life-affirming direction.

Marco Vangelisti is a founding member of Slow Money and the founder of Essential Knowledge for Transition, where he works to empower his clients to learn essential portfolio management skills and to align their financial resources with their values. He is a 100% impact investor and dedicated to democratizing financial literacy and sustainable investing. Marco is an RSF Ambassador and has been an RSF investor since 2004.