News & Resources

Insights from 40 years of regenerative finance

Announcing our new CFO, Marc Diaz

As CFO, Marc is in charge of making sure that RSF’s capital stack and finances are as robust and regenerative as the financial system we’re building in the wider world. Our CEO Jasper van Brakel recently sat down with Marc to learn more about what drew him to RSF, his approach to this leadership role, and his vision for RSF’s future.

Move with Change: A Principle of Regenerative Finance

This blog series breaks down each of the five principles that guide our work in regenerative finance. Here, we’re covering the fifth and final principle: Move with Change.

Transcend Ego: A Principle of Regenerative Finance

This blog series breaks down each of the five principles that guide our work in regenerative finance. Here, we’re covering the fourth: Transcend Ego.

Five Principles of Regenerative Finance: Empower Everyone

This blog series breaks down each of the five principles that guide our work in regenerative finance. Here, we’re covering the third: Empower Everyone.

Five Principles of Regenerative Finance: Center Relationships

This blog series breaks down each of the five principles that guide our work in regenerative finance. Here, we’re covering the second: Center Relationships.

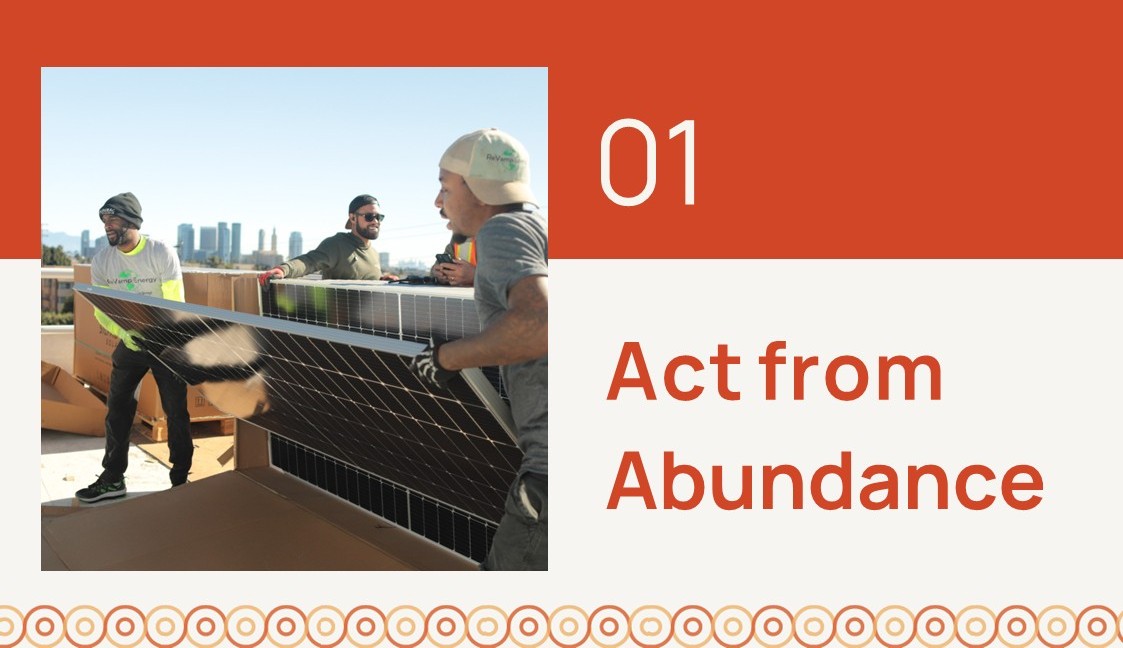

Five Principles of Regenerative Finance: Act from Abundance

This blog series breaks down each of the five principles that guide our work in regenerative finance. Let’s begin with Act from Abundance.

RSF Lends More Than $19 Million to High-Impact Businesses

RSF has issued $19.275 million in loans over the past few months to help seven mission-driven businesses expand their markets and their impact.

RSF Launches Catalyst Fund to Boost Social Enterprise Lending

The Catalyst Fund transforms philanthropy into exponential impact through capital that circulates, opportunities that multiply, and change that endures season after season.

The official RSF gift guide: How to support the social enterprises financed by RSF

Learn more about some of the social enterprises we’ve financed… and where you can purchase their products!

Transforming the Extraction Economy Into a Living System of Regeneration | Bark Media and B the Change

Jasper recently sat down with mission-driven communications firm Bark Media to explore the key lessons RSF has learned in its 40+ years and how the regenerative finance community can change the narrative on the meaning of money.

The rise of regenerative DAFs

How to mobilize the huge cache of assets languishing in donor-advised funds is an urgent question. Our donors’ active grantmaking is advancing new approaches and mobilizing DAF capital to meet the moment.

RSF expands support for climate and energy solutions and launches CUSIP-registered Broker Notes on Bloomberg

Impact leader RSF has issued three new loans to climate and energy borrowers and widened electronic access to its Social Investment Fund (SIF), targeted at investors looking to advance social and environmental innovators.

RSF Social Investment Fund closes first offering of CUSIP-assigned Broker Social Investment Notes on the Bloomberg platform

By bringing Broker Notes to the electronic brokerage market, RSF has made it considerably easier for investors to align their capital with their impact goals.

Diaspora Spice Co: Transforming the spice trade, one farm at a time

From the beginning, Sana Javeri Kadri was determined to build a spice trade that was the opposite of its colonial roots. Financing from RSF helped make that vision a reality.

Why We Give: Interview with the Rosenstein Family

David Rosenstein, Tori Nourafchan, and their children Izzy, Gabe, and Theo Rosenstein have held a donor advised fund as a family since 2020. RSF’s head of communications Will McAneny recently sat down with the Rosensteins to chat about their unique and inspiring approach to giving as a family.