Impact Investing: Lessons from the Field

Feb 4 2013

This is the second post in a series by Morgan Simon on the trends, challenges and opportunities of impact investment, focusing on an exploration of the mechanisms which allow affected communities to lead and shape investments.

In my first post of this series I explored an idea called Transformative Finance; which sets out basic principles for maximizing the social impact of an investment. In short, such investments:

- are primarily designed, managed and owned by those affected by these projects;

- build local assets that support long-term sustainable development on the community’s own terms;

- are designed to add, rather than extract value from communities; and

- balance risk and return between investors, entrepreneurs and communities.

I received a number of comments from investors and social entrepreneurs excited by the concept, and curious if they “qualified” as transformative in their work. In response, as a way to make the point more explicit, I would like to share examples of a social investment gone wrong, and one gone right, in the same community.

With this case in mind, I invite investors and entrepreneurs to take the “transformative challenge”. Ask yourselves: is the local community included in the design, governance and ownership of the enterprise? If not, what has been lost? Looking at the financial flows of the enterprise, how much is staying in the community vs. being exported out of the region or country?

The point of this framing is not to say that all projects must be alike; innovation is one of the sacred hallmarks of entrepreneurship that we want to embrace and support. It is to say: let us be intentional about our impact, and set some basic ground rules for what we want to promote as an industry. As Andy Lower, executive director of the Eleos Foundation and Toniic board member often says, “Making money off of ‘poor’ people is traditional investing – and investors are welcome to do that if they want. Investing where you receive increased financial returns in correlation with increased impact – now THAT’s impact investing.”

So without any further ado—here is the story of several indigenous communities in the southern state of Oaxaca, Mexico and their experience with two very different impact investment projects.

Impact investing gone wrong

The Isthmus of Tehuantepec is one of the world’s greatest areas for wind energy, a fact not lost on energy companies that have invested over $550M in Latin America’s largest wind project. The project will offset several hundred thousand pounds of carbon, while offering attractive returns to investors and jobs for community members. What’s not to like?

As the Mexican press and numerous community organizations have reported, plenty.

“The creation of the wind corridor in the Isthmus of Tehuantepec, developed mainly by Spanish firms, has almost become the new conquest because the indigenous Zapoteco and Ikoot communities have been basically evicted from 12 thousand hectares through unfair and disadvantageous contracts, in order to generate electric energy with their wind and on their land, in the benefit of private initiative.”[1]

Not only has land been taken from communities (for often as little as $50/month in “rent”), but it has been done in an aggressive and violent manner including unlawful detention and physical harm of local protesters speaking out against the project. On November 5th, the Indigenous Peoples’ Assembly of the Isthmus of Tehuantepec noted the following recent actions:

“They fired bullets and discharged pepper spray at women, youth and old people, beating several of those present, including pregnant women. The police detained 9 people, among these 2 women, without giving any information about the charges or where the prisoners would be taken…

No Windpower Project on the Tehuantepec Isthmus

Immediate Liberation of the Detained

Stop the Intimidation, Hostility and Violence Generated by the Wind Power Project[2]”

How did this happen? We are used to seeing this sort of thing happen in environmentally exploitative situations, but not from the clean energy community.

In short, it happened because a foreign company developed a project without thinking through its community engagement strategy or making any attempt to share financial returns fairly. In this instance the concept of “social impact” is undermined and distorted. If is fair to assume that investors in this type of circumstance were told that they were going to be a major force in spreading renewable energy in Latin America—a seemingly great impact story. This demonstrates the challenges associated with defining impact investing, as addressed in my last post: impact cannot simply be defined by investors and entrepreneurs, beneficiaries must be a part of the process.

Impact investing done right

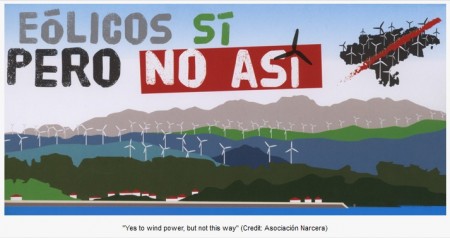

In reaction to the trend of destructive development, community members on the Isthmus, declared that they were not against wind energy, but were against corporate control of their lands. They began to consider ways in which they could implement wind energy on their lands on their own terms. Working with Ashoka fellow Sergio Oceransky of Grupo Yansa, they have come up with a model for community-owned wind that will deliver strong returns to investors while equally benefiting the local community. The project plan explained below was approved in the pueblo’s general assembly, its forum for group decisions-making.

Grupo Yansa’s pilot project will take place in the indigenous Zapotec pueblo of Ixtepec, a large community with over 30,000 inhabitants, endowed with a very rich wind resource. The community maintains common ownership and management over their land and resources, dating back for centuries and codified into law after the Mexican revolution of 1917. The communal property status means that the community cannot use its land as collateral. It is therefore very difficult for them to obtain the magnitude of financing required to develop a wind farm.

However, the largest (and only) Mexican utility offers 20 year contracts to energy producers, locking in production at a fixed price. This means that as long as the community can secure the contract (and of course, execute), it will have guaranteed income for the energy it produces, significantly reducing risk to investors. The investment structure works similar to the practice of factoring—while accounts receivable are not directly purchased, they essentially serve as a guarantee on the investment. A debt structure is being offered to ensure community ownership over the project.

The profit that remains each year after debt servicing will be divided on a 50% basis between the Grupo Yansa and the community. The 50% of profits going to the community will be administered by a community trust devoted to strengthening quality of life, economic opportunities and environmental sustainability. One element of that, for instance, has been creating pension funds for elders—a way to prevent young people from having to migrate, and a benefit that can be equally shared by community members as all will eventually be eligible.

The 50% of profits going to Yansa will be used to finance further projects under the same scheme in other communities. Renewable energy projects will, therefore, finance a broad framework of integral and sustainable community development that is partly based on solidarity and sharing between different communities. Yansa’s financial participation in future projects will be the part of the investment most exposed to risk. This will ideally lower the risk profile of future investments and give Yansa access to a wider scope of institutional investors interested in safe returns and high social and environmental impact.

Closing the chasm

Globally, thousands of communities are deeply concerned about “land grabs” in the name of clean energy (see www.viacampesina.org for numerous examples, from Brazil to Japan). Regardless of the industry, basic questions must be considered: what is our responsibility as impact investors to make sure we are accountable to the communities in which we work? How do we, like Grupo Yansa, find ways to make communities front and center in the design, governance, and ownership of the work?

I do not have a single, simple answer to these questions—the same way that the impact investment community is still struggling to define impact assessment, market rate returns, and alternative deal structures. Let us just make sure that community accountability shares the pedestal as a key element of impact investment. These issues need to be debated, discussed and executed as the impact investing industry goes through its growing pains. We need to continue asking the hard questions and continue building effective frameworks and structures that will support the development of truly positive impact investments.

Morgan Simon is the co-founder and CEO of Toniic, a global network of early-stage social investors. Toniic members share deal flow, due diligence and monitoring on global investments in this action-oriented community looking to move $100 million into global social enterprise. She is also the co-founder of Innovacion Investments, the first community development venture capital fund in Texas, and was the Founding Executive Director of the Responsible Endowments Coalition, leveraging the $400B managed by US colleges and universities. In all her work, she emphasizes community empowerment, leadership and ownership.

Morgan Simon is the co-founder and CEO of Toniic, a global network of early-stage social investors. Toniic members share deal flow, due diligence and monitoring on global investments in this action-oriented community looking to move $100 million into global social enterprise. She is also the co-founder of Innovacion Investments, the first community development venture capital fund in Texas, and was the Founding Executive Director of the Responsible Endowments Coalition, leveraging the $400B managed by US colleges and universities. In all her work, she emphasizes community empowerment, leadership and ownership.

RSF Social Finance is a proud sponsor and member of Toniic.

Note: The opinions expressed in this article are the authors alone and do not claim to represent the opinions of Toniic at large or any individual Toniic member.